Reconciliation Reimagined: How Copilot and Business Central Transform Finance Operations

An ECLEVA Thought Leadership Whitepaper (2025 Edition)

The Hidden Strain of Reconciliation

Manual reconciliation — typically managed across spreadsheets, CSVs, and legacy systems — introduces risk, delays, and error. Month-end becomes a scramble: matching line items, verifying balances, and trying to make sense of fragmented data.

The result? Extended close cycles, limited financial visibility, and reduced confidence in the numbers.

The Root Cause: Disconnected Financial Ecosystems

While effective in isolation, these systems rarely integrate seamlessly, resulting in:

-

Data fragmentation and inconsistency between systems.

-

Manual allocation and matching, particularly for mixed or partial payments.

-

Loss of audit traceability, especially when journals or adjustments occur outside the ERP.

-

Weak compliance controls due to limited role-based permissions and audit logs.

-

Reduced visibility into real-time cash flow and working capital.

These challenges don’t just slow finance down — they limit control, accuracy, and trust across the business.

The Turning Point: Business Central and Microsoft Copilot

AI-Driven Transformation in Action

1. AI-Enhanced Bank Reconciliation

Copilot automatically analyses bank statement data and applies intelligent matching rules.

-

Matches ledger entries using AI pattern recognition.

-

Suggests G/L accounts for unmatched transactions.

-

Flags anomalies or irregularities for review.

Combined with bank feed integrations (e.g. Yodlee, CBA), this creates a streamlined, hands-free process that reduces reconciliation effort dramatically.

2. E-Document and Invoice Matching

3. Real-Time Cash Visibility and Forecasting

Using Azure Machine Learning, Copilot delivers predictive insights on liquidity and cash flow.

Finance teams can explore “what-if” scenarios and forecast working capital based on open invoices, payables, and disbursements — with contextual explanations to guide next steps.

4. Contextual Summaries and Explanations

Copilot summarises large reconciliation journals into key insights, identifies variances, and recommends corrective actions.

What once took hours of manual cross-checking now takes minutes, with clear, AI-generated rationales for every exception.

Beyond Reconciliation: Building the Modern Finance Ecosystem

|

Technology

|

Function

|

|

Business Central Finance

|

Core reconciliation, automation, and audit control

|

|

Power Automate

|

Approval workflows and alerts

|

|

Power BI

|

Real-time dashboards and reconciliation health

|

|

Copilot Studio

|

Custom AI logic and process extensions

|

|

Dataverse & Power Pages

|

Unified data models and secure self-service portals

|

|

Azure Fabric / Data Lake

|

Enterprise data modelling and reporting consistency

|

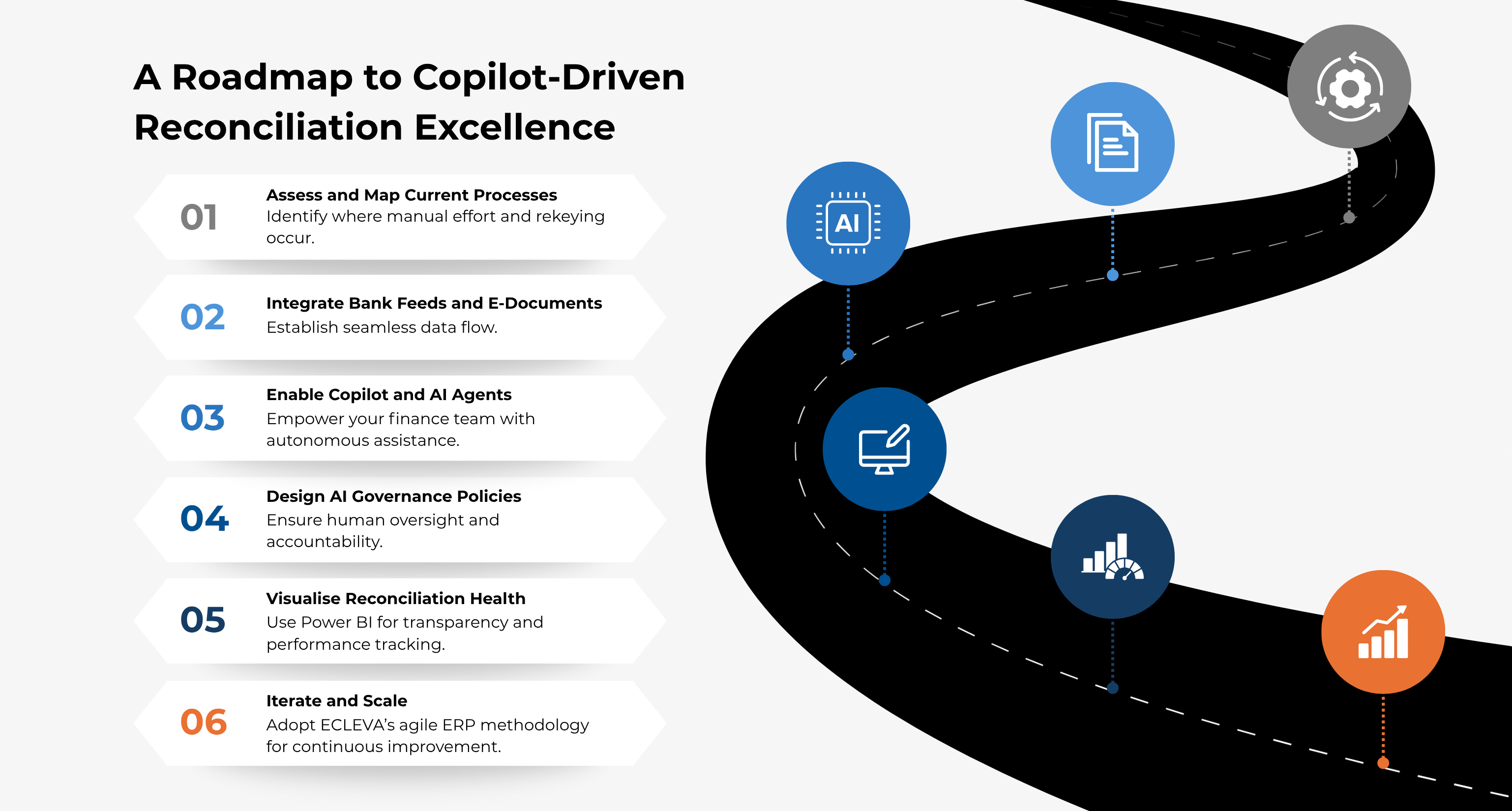

A Roadmap to Copilot-Driven Reconciliation Excellence

-

Assess and Map Current Processes – Identify where manual effort and rekeying occur.

-

Integrate Bank Feeds and E-Documents – Establish seamless data flow.

-

Enable Copilot and AI Agents – Empower your finance team with autonomous assistance.

-

Design AI Governance Policies – Ensure human oversight and accountability.

-

Visualise Reconciliation Health – Use Power BI for transparency and performance tracking.

-

Iterate and Scale – Adopt ECLEVA’s agile ERP methodology for continuous improvement.

The Payoff: Clarity, Control, and Confidence

With Microsoft Copilot and Business Central, finance leaders gain a self-improving reconciliation process — one that continuously learns from user behaviour and improves over time.

-

Close cycles shorten from weeks to days.

-

Data integrity strengthens, enabling trust across stakeholders.

-

Teams focus on strategy, not spreadsheet firefighting.

“Copilot doesn’t just speed up reconciliation — it transforms it into an intelligent, self-improving process.”

— ECLEVA Finance Transformation Insight, 2025

About ECLEVA

Since 1996, ECLEVA has helped organisations unlock productivity and growth through Microsoft technologies.

As a Microsoft Solutions Partner specialising in Microsoft Dynamics 365 Business Central, Copilot, Customer Engagement, Marketing and Power Platform, ECLEVA designs solutions that simplify financial complexity, automate compliance, and deliver measurable business outcomes.

Learn more at www.ecleva.com